Why Mercury Dominates the Performance Offshore Engines Market

How Mercury gained dominance in the offshore performance engine space.

August 3, 2025

Mercury Marine leads the performance offshore engines market, outpacing competitors like Evinrude, Yamaha, Honda, and Volvo Penta. Its dominance stems from innovative technology, a focus on high-performance applications, and a robust historical foundation. Below, we explore Mercury’s success, weaving in historical context and comparisons with these relevant brands, using brief sentences and transitional words for clarity.

Historical Context of Outboard Engine Brands

Founded in 1939, Mercury Marine quickly rose to prominence in outboard motor manufacturing. By the 1960s, it captured significant U.S. market share with reliable, powerful engines. Evinrude, established in 1907 by Ole Evinrude, pioneered two-stroke technology and competed fiercely with Mercury until the 2000 bankruptcy of its parent company, Outboard Marine Corporation. Acquired by Bombardier in 2001, Evinrude’s E-TEC engines regained traction but were discontinued in 2020 due to market pressures and COVID-19.

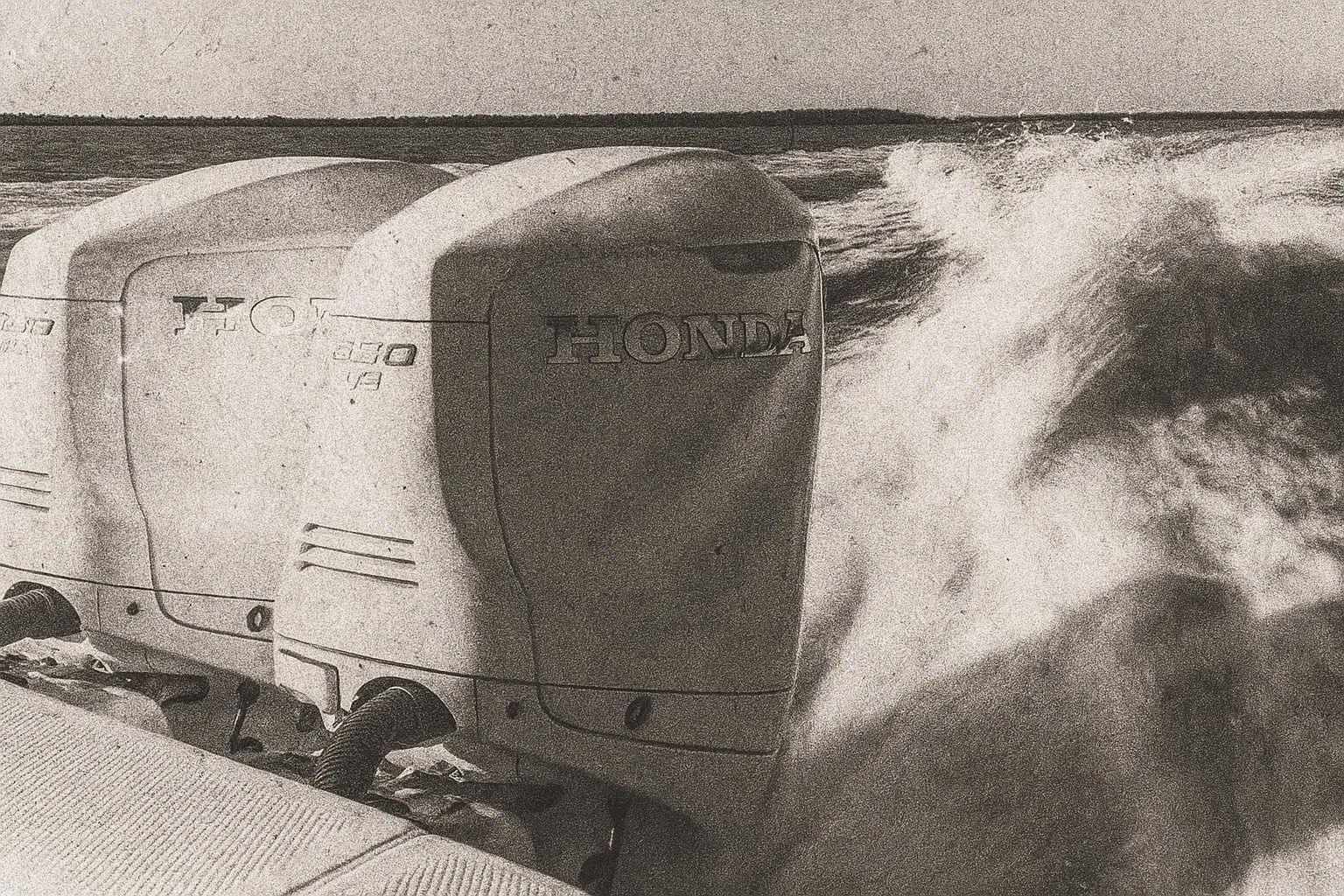

Yamaha, entering the outboard market in the 1960s, became the second-largest manufacturer by the 2000s, known for durable four-stroke engines. Honda, also starting in the 1960s, focused on fuel-efficient, quiet four-stroke motors, gaining a foothold in recreational boating. Volvo Penta, a leader in inboard and sterndrive systems since the 1950s, entered the outboard market through its 2017 acquisition of Seven Marine, targeting high-performance applications. These brands—Evinrude historically, and Yamaha, Honda, and Volvo Penta currently—are Mercury’s most relevant competitors due to their market presence and technological advancements.

Mercury’s Technological Edge

Mercury’s leadership is driven by advanced engineering. Its Verado line, launched in 2004, offers supercharged four-stroke engines with up to 600 HP, featuring joystick piloting and SmartCraft integration for precision control. These engines excel in large offshore boats. In contrast, Evinrude’s E-TEC G2 engines, before discontinuation, provided low emissions and torque but lacked the high-horsepower range of Mercury. Yamaha’s XTO Offshore series, like the 450 HP model, prioritizes reliability and fuel efficiency for fishing and cruising. Honda’s BF350 V8, a recent 350 HP model, uses VTEC for efficiency but focuses on smooth operation. Volvo Penta’s Seven Marine engines, such as the 627 HP model, deliver high power but are heavier and less integrated for offshore performance.

Image by VÉHICULE

Market Focus and Performance Orientation

Mercury targets high-performance offshore boats, particularly large center consoles and sportfishing vessels. Its 4.6L V8 and V12 Verado engines and Pro XS series (up to 300 HP) offer unmatched power and lightweight designs for speed. Historically, Evinrude’s G2 engines competed in performance but were limited by weight and discontinuation. Yamaha focuses on versatility, with models like the F250 and XTO 450 excelling in reliability but not in the 500+ HP range. Honda’s BF250 and BF350 cater to family-oriented and cruising boats, emphasizing quiet operation. Volvo Penta’s Seven Marine engines target luxury performance markets but are constrained by cost and specialization. Thus, Mercury’s broad performance range maintains its edge.

Image by VÉHICULE

Weight and Design Advantages

Weight is critical for performance outboards, and Mercury balances power with manageable weight. Its 115 Pro XS weighs 360 lbs, lighter than Yamaha’s 115 VMAX SHO at 377 lbs, ideal for smaller performance hulls. Mercury’s Command Thrust gearcase enhances versatility for larger boats. Evinrude’s G2 engines, weighing up to 418 lbs, were less competitive in weight-sensitive applications. Honda’s BF150 (217 kg) is competitive but underpowered for offshore performance. Volvo Penta’s Seven Marine 627 HP engine, exceeding 1,000 lbs, limits its versatility. Therefore, Mercury’s design optimizes performance across boat sizes.

Market Share and Brand Strength

By 2007, Mercury held a 32% U.S. market share, followed by Yamaha at 30%, Honda at 10%, and Evinrude at 8%. Volvo Penta’s outboard share, via Seven Marine, remains small but is growing in high-end segments. Mercury’s early four-stroke investment and high-horsepower focus solidified its lead. Its global dealer network and reliability bolster its position. Evinrude’s market presence waned after 2000, and its 2020 exit allowed Mercury to capture more share. Yamaha excels in the 150–300 HP range but prioritizes broader applications. Honda’s durability is strong, but its recreational focus limits performance appeal. Volvo Penta’s niche in luxury boats is constrained by cost. Thus, Mercury dominates the high-performance offshore market.

Image by VÉHICULE

Challenges Faced by Competitors

Evinrude’s 2020 discontinuation ended its historical rivalry with Mercury. Its E-TEC G2 engines offered torque and low emissions but struggled with weight and repair complexity. Yamaha’s reliability is exceptional, but its XTO series prioritizes efficiency over raw power. Honda’s BF350 provides smooth operation but lacks horsepower for top-tier performance boats. Volvo Penta’s Seven Marine engines are powerful but expensive and heavy, reducing versatility. Additionally, Volvo Penta’s limited outboard dealer network and Honda’s recreational focus hinder their performance market reach. As a result, Mercury faces minimal competition in the 400+ HP segment.

Image by VÉHICULE

Consumer Perception and Reliability

Mercury’s outboards last up to 3,000 hours with proper maintenance, earning strong reliability ratings. Evinrude’s two-stroke engines were durable but faced repair challenges due to complex designs, contributing to its decline. Yamaha matches Mercury in reliability, especially in saltwater, but its quieter engines appeal to recreational users. Honda’s engines are praised for longevity and low noise, ideal for cruising. Volvo Penta’s Seven Marine engines have a strong luxury reputation but face concerns about maintenance costs. Consequently, Mercury’s balance of reliability and performance resonates with offshore enthusiasts.

Conclusion

Mercury dominates the performance offshore engines market with its high-horsepower Verado and Pro XS lines, offering power, lightweight designs, and advanced features like SmartCraft and joystick piloting. Historically, it outpaced Evinrude, which faltered after 2000 and ceased production in 2020. Current competitors like Yamaha, Honda, and Volvo Penta focus on reliability, recreational boating, or luxury niches, respectively, but lack Mercury’s performance emphasis. Therefore, Mercury’s strategic focus on high-performance offshore applications ensures its continued leadership in the market.